The Battle of GameStop

Over the past several weeks, GameStop stock has traded more like a cryptocurrency than a failing mall-based retailer.

What is going on here?

In one sentence: Institutional investors short GameStop (i.e., the prevailing wisdom, at least until the past few weeks) are playing a game of chicken with retail investors & contrarian institutions who are long.[1]

The Current Situation

GameStop is a video game retailer; it has been in decline for several years now. Video games have moved to an online, direct-to-consumer distribution model. Foot traffic in malls (where most GameStops are located) was down even before COVID; many mall-based retailers are struggling.

Unsurprisingly, over the course of 2020 this led to GameStop becoming one of the most shorted stocks on Wall Street.

However, there were early signs that GameStop was undervalued. Michael Burry (of The Big Short fame) took a large long position in 2019, claiming video game discs are not entirely dead. In August 2020, Roaring Kitty (a.k.a. u/DeepFuckingValue on Reddit) published a video detailing why GameStop was a good play based on its fundamentals – a future short squeeze would just be the icing on the cake.

On January 11th, Ryan Cohen (founder of Chewy, which sold to PetSmart for $3.35 billion), joined GameStop’s board after his investment firm built up a 10% stake in the company. At this point, retail investors, especially those on the popular subreddit Wall Street Bets went crazy. They highlighted that GameStop was now a growth play. It is now led by a previously successful founder, its online business is growing at a 300% rate, and it is in the process of turning around its core business.[2] As such, GameStop should be valued at a Venture Capital multiple of 10x+ revenue, rather than a measly 0.5x revenue.

This narrative is compelling. Despite short sellers warning otherwise, GameStop has continued to climb in price. All of the GameStop options issued (with a high strike price of $60) were in the money on Friday (1/22/2021), trigging a gamma squeeze as institutions who had written the options rushed to cover their positions. GameStop closed Friday at $65.01.

On Monday (1/25/2021), GameStop opened at $96.73, spiked at $159.18 (likely because of another gamma squeeze),[3] then crashed with pressure from institutional shorts, closing at $76.79 (still up 18% day-over-day).

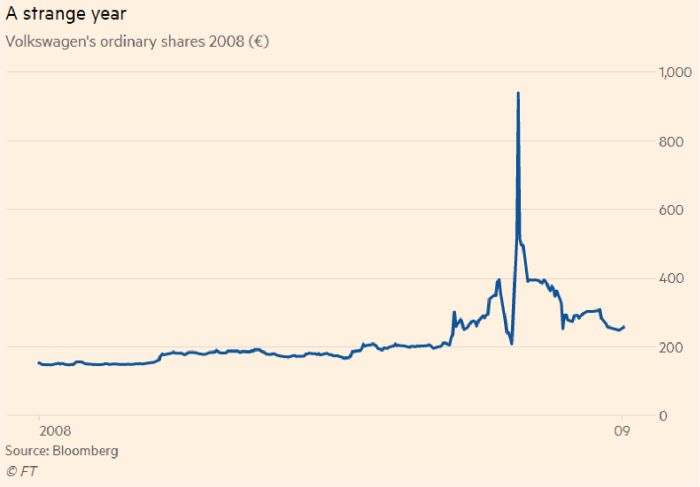

But the bulls aren’t finished with GameStop. These gamma squeezes are nothing compared to what will be coming: the near-mythical “Infinity Squeeze”. Most famously seen with Volkswagen in 2008, when short sellers are forced to cover their positions due to a margin call, the price of the stock rapidly rises (hypothetically to infinity) since the number of shares shorted exceeds the number of shares available to buy.

The Allure of Wall Street Bets

Can a subreddit comprised of retail investors really move the market like this? I doubt it – all of the big swings in this stock have been caused by institutions. What this subreddit does is control the narrative.

First unveiled to the mainstream finance world in a February 2020 Bloomberg article, Wall Street Bets is profane (as I’m sure you’ve noticed if you clicked any of the links in this post). But Wall Street Bets isn’t some sinister, market-manipulating entity. Rather, it is a virtual water cooler for individual retail investors to post memes – and emojis, oh so many emojis – about their investments.

Reading Wall Street Bets feels like the discussion at a middle school cafeteria table circa 2000. Redditors on Wall Street Bets (who refer to themselves affectionately as “autists” or “retards”)[4] encourage one another to have “diamond hands” (💎 🤲), the will to stay strong and not sell a stock when things are going poorly. Contrast this with the “paper hands” (🧻 🤲) of those who are weak-willed and sell a stock based on market sentiment. Companies are headed “to the moon” (🚀). Bears are not mentioned without the adjective “gay” (🌈 🐻). Self-deprecating cuckold references to “my wife’s boyfriend” abound.

Despite this language (or perhaps because of it), Wall Street Bets is one of the most entertaining and informative places on the internet. People post meaningful analysis of companies that are undervalued and why they are investing. Browsing the subreddit, you get a crash course on concepts that you would otherwise learn only at a buy-side firm or working as an options trader: EBITDA multiple, book value, delta hedging, implied volatility.

But the most compelling aspect of Wall Street Bets is in its name: the bets. The ability to gain (or lose) a life-changing amount of money – with screenshots to prove it – creates an environment similar to that of the casino floor. And if Wall Street Bets is the casino floor, then Wall Street itself is the house.

The same emotion that caused us to root for the thieves in Ocean’s 11 is what makes Wall Street Bets so enticing. Put frankly, Millennials are tired of getting fucked by the man. When you’re underemployed with $100,000 in student loan debt, your financial situation feels overwhelming. You really don’t want to take the advice of your parents or CNBC talking heads[5] to invest 10% of your salary for a 4% annual return. At that point, what’s another $5,000? Might as well buy some short-dated GME calls.

For those of use who don’t fit the underemployed Millennial archetype, Matt Levine’s Boredom Markets Hypothesis applies. COVID has required us to work from home, without much ability to spend for travel, dining, or entertainment. Putting money into Robinhood is a decent substitute – with the added bonus of it being an “investment”, rather than consumption. In an age where the Fed will print seemingly unlimited money to prop up capital markets, better to be irrational exuberant as a part of the market than be left out of the party.

Further, the narrative presented by the GameStop trade in particular is compelling. It allows the small retail investor to play a role in market events normally only played out at the hedge fund scale (a short squeeze was a key plot element in Season 1 of Billions). The short sellers in this case aren’t particularly sympathetic: Andrew Left of Citron Research released a video in which he lays out the bear case for GameStop. His main argument was a smug appeal to authority, essentially claiming “Wall Street knows better than you people on message boards”.[6]

So sure, Wall Street Bets is irreverent, has irrational exuberance, and is guilty of hero worship (Elon Musk and more recently Ryan Cohen). But it also provides a sense of community during the stresses of COVID and provides a compelling way for the little guy to stick it to the man.

As Keynes reminded us (in the most overused finance quote of all time): “The markets can remain irrational longer than you can remain solvent.” When enough people believe in a vision, it can cause that vision to manifest itself. Wall Street is scared that retail investors can manifest their own vision, rather that the one dictated by the major financial players.

What George Soros Got Right

The entire GameStop scenario is a case study in reflexivity.[7] Reflexivity is the idea that our perception of circumstances influences reality, which then further impacts our perception of reality, in a self-reinforcing loop. Specifically, in a financial market, prices are a reflection of traders’ expectations. Those prices then influence traders’ expectations, and so on.

This may seem obvious to some, but it flies in the face of the efficient-market hypothesis. As Soros states,

What makes reflexivity interesting is that the prevailing bias has ways, via the market prices, to affect the so-called fundamentals that market prices are supposed to reflect.[8]

What does this mean for GameStop? Because of traders’ bullish sentiment, a previously failing company is now in the position where it can leverage the overnight increase in value to make real, substantive changes to its business. GameStop can pay off debt through the issuance of new shares or make strategic acquisitions using its newly-valuable shares.[9] A struggling company could become solid simply not because of a change in the underlying business, but because investors decided it should be more valuable.

Reflexivity may be the best way to understand the 21st Century. Passive investing is an example of reflexivity in action.[10] So is winner-take-all venture investing. Uber raised an absurd war chest, causing more investors to want to pile in, which led to more fundraising and eventually a successful IPO. The fact that Uber has not yet turned a profit, yet today has a $100 billion market cap, cannot be explained with traditional financial thinking, but can be explained by reflexivity.

The internet and instant communication only accelerates these trends. Instances of reflexivity like the strange market movements we’ve seen with GameStop are happening more and more – not only in financial markets, but also in the political and social realm, to incredible effect.

When Donald Trump won the presidency in 2016, I distinctly remember writing in my journal: “Anything is possible.” I was blown away that this complete buffoon of a man, someone who the Huffington Post refused to cover as politics meme-d his way into the presidency. He was a joke, until suddenly, in a Tulpa-esque twist…he wasn’t. Similarly, internet conspiracy theories spread via Facebook memes manifested themselves in the real world when Trump supporters stormed the Capitol a few weeks ago.

Our perception shapes reality. And when enough people agree on a specific perception, it becomes reality.[11] As we become more and more connected, discourse will expand and and accelerate. We’re going to see some strange things become reality.

Even, perhaps, hedge funds going bankrupt and newly-minted millionaires, all because of some people who wrote about a struggling video game retailer on Reddit.

For the best summary of the current situation, see Matt Levine. ↩︎

When you take into account the closures of poorly-performing stores, per-store revenue and profits are up. ↩︎

Options were written up to a strike price of $115 and these all were in the money. ↩︎

Not condoning the language, but Wall Street Bets members with trading gains often make donations to these causes. ↩︎

Wall Street Bets has a love/hate (mostly hate) relationship with Jim Cramer, a.k.a. “Chillman Boomer”. ↩︎

Andrew Left is an interesting character. That said, I’m not here to attack him personally, and nobody in their right mind would condone the alleged threats made against him by GameStop bulls upset by his stance on the company. ↩︎

Good intro to Soros’s Theory of Reflexivity in this Financial Times article. ↩︎

The Alchemy of Finance, page 10. ↩︎

More details in this Reddit post. ↩︎

Passive investing is also helping GameStop’s run – as the price of the stock increases, index funds need to buy more shares to re-weight, which in turn drives up the price. Reflexivity. ↩︎

This is my favorite rebuttal for those who claim “cryptocurrency has no intrinsic value”. Sure – but neither does the U.S. dollar. We just all decided that it would have value, so it does. ↩︎